Capitol Update - January 15, 2026

UEN Legislative Update

January 15, 2026

(Download this week's printable UEN Legislative Written Report)

This UEN Weekly Report from the 2026 Legislative Session includes:

- Governor’s Budget Recommendations: SSA, Budget Guarantee and Other Impacts

- Senate and Governor Release Property Tax Relief Proposals

- Bills Introduced

- Advocacy Actions for the Week

- Advocacy Resources

Governor’s Details on SSA, Budget Guarantee and PK: (Source: LSA Analysis of the Governor’s Recommendation https://www.legis.iowa.gov/docs/publications/LAGRP/1595211.pdf)

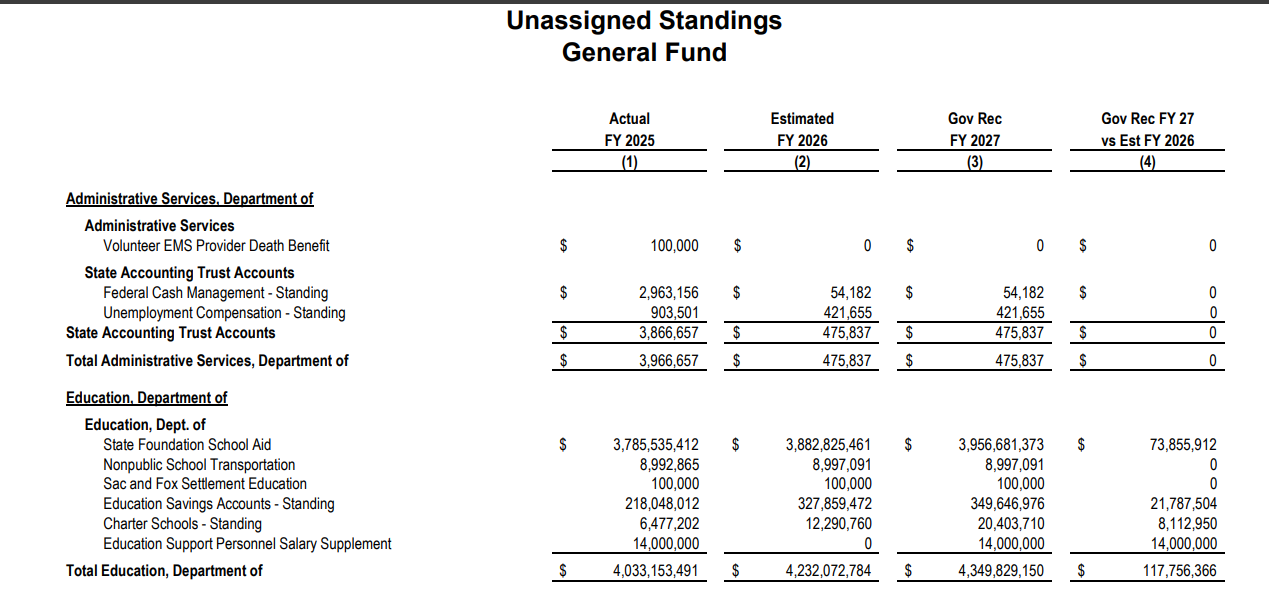

Gov. Reynolds’ Budget Recommendation includes a State General Fund appropriation of $3.957 billion for State aid to schools in FY 2027, an increase of $73.9 million compared to the estimated FY 2026.

- Reflects an SSA percent of growth rate of 2% and continues the $25.0 million reduction to the Area Education Agencies (AEAs), which is in addition to the statutory reduction of $7.5 million currently specified in the Iowa Code.

- The amount reflects a continuation of the adjustment for Property Tax Replacement Payment (PTRP) funding, which is estimated to increase from $242 to $260 per pupil.

- Applies the SSA percentage increase to categorical funds (2% increase in the state cost per pupil for TSS, for example, is $13.69, which as a dollar amount would be added to your district’s TSS cost per pupil).

- The 2% increase in SSA also applies to various finance multipliers in the formula, such as special education weighting, concurrent enrollment, English-Learner weighting and preschool.

- Deductions from districts for students enrolled in charter schools are estimated to be $12.3 million. This amount is removed from school district budgets to pay for second and subsequent years of charter school funding and includes RPDC, per pupil categoricals (includes professional development, teacher leadership and compensation and early intervention class size, but not teacher salary supplement), and provides funding for special education and EL weightings.

- The Governor is proposing a new idea, recommending $42.2 million for payment of school district budget adjustment guarantee amounts that have been paid with property taxes in past fiscal years. Although this number is part of the $73.9 million increase, it will not provide more funding for school districts. This is property tax relief. If the $42.2 million was used to fund a higher SSA percentage, it would generate additional spending authority and cash for districts used to educate students and also result in lower budget guarantee property taxes for FY 2027.

- More detail will be shared next week when the LSA Staff releases their specific Analysis of FY 2027 Governor’s Recommendations for Unassigned Standings Appropriations and Education Appropriations.

This tracking of Unassigned Standings Appropriations from the LSAs Analysis also shows changes in Charter School Funding and Education Savings Accounts Funding, as well as the inclusion of $14 million for education support personnel compensation. This $14 million was funded in the current fiscal year via the Sports Wagering Fund. It is good to see it as a General Fund Appropriation recommended by the Governor.

Update on ESAs (Enrollment and Funding Assumptions):

ESAs are funded by a standing unlimited state general fund appropriation. Here are the costs by fiscal year, with FY 2027 being the Governor's estimated budget (2% SSA plus an estimate on how many will be awarded, either of which could change by the time school starts in August):

- FY 2024 $129.1 million 16,757 ESA recipients

- FY 2025 $218.0 million 27,862 ESA recipients

- FY 2026 $314.6 million estimated appropriation and 41,044 ESA recipients

- FY 2027 $349.6 million Governor’s Recommendation assuming 2% SSA and 42,898 ESAs

Total nonpublic school enrollment reported on DE’s Education Statistics webpage for FY 2026 is 42,898. That is an increase of 2,467 compared to the 2024-25 school year.

Governor’s Property Tax Relief Proposal HSB 546 and SSB 3031 Summary

Summary of HSB 563 Governor’s Property Tax Overhaul Bill

- Establishes a 10% cap on unassigned reserve funds in local government general funds (excluding schools) starting July 1, 2027; excess reserves must be remedied before budgets are certified. Requires audits to examine compliance with and verify circumstances resulting in actual reserve funds exceeding the limits.

- Limits annual property tax levy growth for local governments (excluding schools) to 2% plus new valuation growth, with adjustments for voter-approved levies; noncompliant budgets are subject to state intervention and forced reduction.

- Prohibits the use of bonds or property tax-funded debt to pay for general operations of local governments after July 1, 2026.

- Increases commercial and industrial property small business benefit from $150,000 to $250,000 of valuation (applies residential rollback to first $250,000).

- Converts the homestead property tax credit to an exemption of $4,850 in taxable value, eliminates the state reimbursement to local governments, and restructures the elderly/disabled credit as a ‘property tax growth credit’ with new eligibility (no longer restricted to lower income) and calculation rules (over 65 or disabled).

- SAVE: Accelerates the equity transfer percentage from SAVE to property tax relief, currently estimated to transition slowly up to 30% by 2051, to instead, increase from current level just over 5%, (about $34 million) to 15% of SAVE Revenue in FY 2027, 20% in FY 2028, 25% in FY 2029 and 30% (or about $192 million) in FY 2030. Also requires DOM to reconcile the actual SAVE amount for school districts in the fiscal year immediately following the fiscal year during which the revenues were collected.

- Restricts new urban renewal projects (TIF) to only specific activities: 1) acquisition of a portion of a property slum or blighted area, or economic development area to be used for installation, construction, or reconstruction of utilities or streets that directly serve the area if the utilities or streets are necessary for furtherance of the urban renewal plan, 2) demolition and removal of buildings and improvements located on the portion of the property in #1, and 3) Sale of public property within the urban renewal area for uses in the urban renewal plan. Limits the duration of new tax increment ordinances to 20 years and prohibits expansion or new debt for existing TIF areas after enactment. Specifies that school district taxes are exempt from TIF division and requires school taxes collected on the property be paid to the school district.

- Moves the property reassessment and equalization cycle to every 3 years (from every 2 years), and requires detailed justification and statement to taxpayers for assessment increases of 15% or more from the prior assessment, shifting the burden of proof to the assessor in certain appeals.

- Creates a Local Government Shared-Services Grant Fund to incentivize consolidation and service sharing among local governments.

- Establishes the FirstHome Iowa savings trust for first-time homebuyers with state tax benefits (modeled on 529 education savings plans).

- Requires a Property Assessment System Tax Force to study and report by January 1, 2027, re: a) Assessor qualifications and education, b) Assessor selection and retention, c) Functions of conference boards and examining boards, d) Property assessment procedures, frequency, and timelines, e) Property tax assessment protest and appeal procedures and burdens of proof. Allows the DOR to convene a task force of local and state officials and technical experts to assist in the review.

- Changes the county auditor, treasurer, and recorder from elected to appointed officials, with current office holders finishing their terms before the new system takes effect. Sets 4-year terms.

- Requires a study committee to evaluate and make recommendations about the entire property tax valuation assessment system.

- UEN is opposed to the SAVE acceleration but appreciates the changes to TIF and the sparing of school districts from several of the other limitation proposals. We are still evaluating our position on the bill.

Senate’s Property Tax Relief Proposal SSB 3001 Summary

- Division III: School Property Taxes July 1, 2027

- Sets regular program foundation base at 100% and sets special education support services foundation base at 100%. These two actions lower additional levy property taxes.

- Adds media and education services to the combined district cost

- Lowers uniform levy to $4.48662

- Sets reorg incentive uniform levies for years 1-3 at $3.66, $4.07, and $4.28. Returns to $4.48662 in year 4 following the reorganization.

- Transfers an amount sufficient to pay for the increase in the regular program foundation base to 100% from the SAVE to the state’s General Fund (page 21, line 23). This amount will decrease each year as the rollbacks are gradually eliminated and the uniform levy generates more revenue. We are still investigating how far this extends – it might be just a continuation of the current year's equity transfer, but the wording is unclear.

- Transfers ending balances of property tax equity & relief fund (from SAVE), property tax adjustment general fund appropriation ($24 million), and property tax replacement payments (state general fund appropriation) to where they came from June 30, 2026.

- Management Fund: Requires districts to report to SBRC all FY 2026 unexpended fund balances that exceed FY 2026 expenditures by 11/15/26. Requires SBRC to evaluate balances and expenditures and to consult with school boards and other experts to determine the appropriateness of establishing unexpended fund balance limitations for the management fund. The SBRC is required to make recommendations to the General Assembly by February 1, 2027, for fiscal years beginning on and after July 1, 2029.

- Phase-In Schedule for Maximum Management Fund Balances: Starts at 180% of the average of prior three years expenditures in FY 2021 and drops to 160% in 130% in FY 2023.

- Division IV Rollbacks & Levy Rates:

- Phases out residential rollback over 12 years.

- Phases out commercial rollback effective for valuations for the 1/1/26 assessment year. First $150K of commercial value receives the 12-year residential rollback benefit each year.

- Limits total PPEL to $1.18 (Board PPEL at 24 cents and VPPEL at 94 cents).

- Limits bond levies to $1.89 and $2.84 (does not apply to bonds issued for elections held on or before November 4, 2025, and sold on or after May 2026).

- Sets voted levies at 70% of the prior rate limits.

- Allows school boards, by resolution, to set a higher limit if necessary to make bond payments.

- Division V: Homestead and Other Credits and Exemptions

- Homeowners over 60 years old with no mortgage are exempt from paying property taxes, phased in over four years, beginning in the assessment year January 1, 2026, through January 1, 2029, eventually at 100% of valuation.

- Phases in the homestead credit, which starts at 25% of the value not to exceed $175,000, beginning with the assessment year, January 1, 2026. Gradually increases to 50% of the value through the assessment year beginning January 1, 2036, not to exceed $350,000. (Current homestead exemption is $4,850 for all residential property taxpayers.)

- Several other smaller exemptions and credits are expanded.

House Property Tax Reform Proposal:

Speaker Grassley stated on Iowa Public Radio’s River to River program on Monday, January 12, that he expected the House proposal to be introduced early next week.

Bills Introduced:

We are still working on bill registrations of lobbying position – stay tuned for more information soon:

Senate Education Committee Bills Impacting PK-12 Education:

|

Bill |

Bill Title |

|

A bill for an act relating to human growth and development course enrollment at school districts and to pupil attendance at educational conferences or seminars in which human growth and development information is provided. |

|

|

A bill for an act relating to education, including by modifying provisions related to the protected speech and expression rights of students enrolled in school districts, charter schools, and innovation zone schools, duties of the DE, and providing civil penalties. |

|

| SF 2061 | A bill for an act establishing a nonpublic school safety infrastructure grant program and making appropriations. |

|

A bill for an act relating to eligibility standards for certain education programs and tax provisions based on religious or sectarian use or purpose, and including retroactive applicability provisions. |

|

| SF 2044 | A bill for an act relating to the responsibilities of school districts and charter schools related to the discipline of students who cause violent or nonviolent disruptions. |

|

A bill for an act relating to school district general fund flexibility accounts by expanding eligible funding sources and modifying expenditure approval requirements. |

|

|

A bill for an act relating to special education, including by requiring accredited nonpublic schools to provide special education services to students enrolled in the school who require such services and modifying the responsibilities of area education agencies, and including effective date provisions. |

|

| SF 2010 | A bill for an act relating to the transportation to and from school of pupils participating in open enrollment (eliminates the 2-mile limit). |

|

A bill for an act establishing requirements related to nonpublic schools that receive tuition payments from parents or guardians whose students are participating in the education savings account program. |

|

|

A bill for an act relating to school districts that share the operational functions of a school resource officer, and including applicability provisions. |

|

|

A bill for an act relating to physical activity requirements applicable to students enrolled in public schools and accredited nonpublic schools. |

|

|

A bill for an act providing for supplementary weighting for school districts that share career and technical education instructors. |

|

|

A bill for an act authorizing the expenditure of funding from the SAVE fund for certain insurance costs. |

|

|

A bill for an act prohibiting school districts, charter schools, and innovation zone schools from providing any program, curriculum, test, survey, questionnaire, promotion, or instruction relating to gender theory or sexual orientation instruction in grades 7-12. |

|

|

A bill for an act requiring the board of educational examiners to establish additional endorsements for instruction related to fine arts, mathematics, and science. |

|

|

A bill for an act relating to education, including by modifying provisions related to the Iowa statewide assessment of student progress and programs for gifted and talented children, and by requiring school districts to develop an advanced mathematics pathway and implement procedures for subject acceleration and whole-grade acceleration. |

|

|

A bill for an act requiring boards of directors of school districts, governing boards of charter schools, and authorities in charge of accredited nonpublic schools to adopt policies related to excusing student absences for 4-H club or FFA activities. |

|

|

A bill for an act relating to the verification of the identity and employment eligibility of individuals by the board of educational examiners, school districts, accredited nonpublic schools, charter schools, and innovation zone schools, and including applicability provisions. |

House Education Committee Bills Impacting PK-12 Education:

|

|

Advocacy Actions This Week:

Adequate School Funding: Contact legislators regarding SSA. The Governor’s recommendation of 2.0% falls short of inflation (as has every SSA increase over the last five years).. The teacher salary investment last year was a really good start, but SSA has to keep pace, or our staff and programs for students will be compromised. See the UEN Issue Brief for additional information. The deadline for deciding SSA is February 11, so the advocacy window is tight. No bills sponsored by Republicans have yet been introduced to set the SSA rate. Additional Supports:

- Download the UEN 2026 Adequate School Funding Issue Brief, providing education funding history, comparing total Iowa education expenditures per pupil, which most recently ranked our state as 35th in the nation, now spending over $2,700 less per student than the national average, and including some talking points to help you advocate with your legislators. UEN’s Legislative Priority supports an SSA rate that at least matches the inflation rate schools are experiencing.

- The REC sets a revenue growth estimate for FY 2027 of 4.2%. Shouldn’t school benefit from the general fund recovery?

- The ISFIS New Authority Calculator allows users to set the SSA rate and calculate the impact across all districts for FY 2027 on your regular program (not including special education or other supplementary weightings). Enter the SSA percentage increase to compare to the new money you’d receive if the SSA rate was higher than the Governor’s Recommendation of 2.0%. Check our the new tab to determine the impact of 2% on your TSS and other per pupil categoricals and media and education services. What would that additional authority provide for students? What happens if your school experiences a few more years of 2% or lower?

Property Tax Relief: Encourage legislators to get fiscal estimates from LSA and DOM before proceeding with big system changes. The property tax system is complicated. Multiple changes to all three components of the system are very hard to predict. The Senate’s proposal, in particular, significantly changes or limits all three components: Valuation, Rates and Total Levy (dollars collected). Protect schools, since they are already primarily budget-limited and enrollment-driven under the foundation formula. See the UEN Property Tax Reform 2026 Issue Brief for additional taking points and items to discuss with your legislators.

Quality Preschool and Other UEN Priorities: In every communication, find a way to mention Quality Preschool and Teacher (especially special education) and other Staff Shortages. Find Issue Briefs and other resources on the UEN Website to find talking points or as resources to share when you meet with policymakers.

Connecting with Legislators: To call and leave a message at the Statehouse during the legislative session, the House switchboard operator number is 515.281.3221 and the Senate switchboard operator number is 515.281.3371. You can ask if they are available or leave a message for them to call you back. You can also ask them for the best way to contact them during session. They may prefer email, text message, or a phone call, based on their personal preferences.

Find out who your legislators are through the interactive map or address search posted on the Legislative Website here: https://www.legis.iowa.gov/legislators/find

Other UEN Advocacy Resources:

Check out the UEN Website at www.uen-ia.org to find Issue Briefs, these UEN Weekly Update Reports and Videos, UEN Calls to Action when immediate advocacy action is required, testimony presented to the State Board of Education, the DE or any legislative committee or public hearing, and links to fiscal information that may inform your work. The latest legislative actions from the Statehouse will be posted at: www.uen-ia.org/blogs-list. The 2026 UEN Advocacy Handbook will be available and posted soon at www.uen-ia.org/advocacy-handbook.

Contact Us

Margaret Buckton

UEN Executive Director

margaret@iowaschoolfinance.com

515.201.3755 Cell

Thanks to our 2025-26 UEN Corporate Sponsors:

Special thank you to your UEN Corporate Sponsors for their support of UEN programs and services. Find information about how these organizations may help your district on the Corporate Sponsor page of the UEN website at www.uen-ia.org/uen-sponsors.

- 10Fold Architecture + Engineering - www.10foldarchitecture.com

- INVISION Architecture - www.invisionarch.com

- Solution Tree - www.solutiontree.com/st-states/iowa